E2E Accounting has got your back when it comes to offering valuable assistance in bookkeeping and other accounting services through our experts at a reasonable cost.

E2E Accounting has got your back when it comes to offering valuable assistance in bookkeeping and other accounting services through our experts at a reasonable cost.

At an affordable price and robust financial reporting with a zero learning curve.

Struggling to manage cash flow positively? The E2E Accounting team will develop a centralised cash flow management strategy especially to help you efficiently manage your business cash.

It can be unpleasant to be placed on an emergency tax code; all of a sudden, more taxes are deducted...

It can be thrilling and risky to invest in small, startup companies. The Enterprise Investment Scheme (EIS), which offers tax...

Being self-employed is a great thing, as you are your own boss. But at the same time, managing a business...

Businesses in the UK may find it difficult to navigate the complicated world of corporate taxation, particularly in light of...

HMRC warns of scams targeting people filing self-assessment tax returns – learn how to spot fraud, report scams, and file...

Receiving a letter from HMRC doesn’t always mean you’ve made a mistake. The P800 refund letter is good news—it means...

Our team of professional accountants is Xero & QuickBooks certified, so we can work with every major accounting software, including QuickBooks, Xero, Sage, SAGA, and more. We can also sync financial data from other bookkeeping software that you may be using.

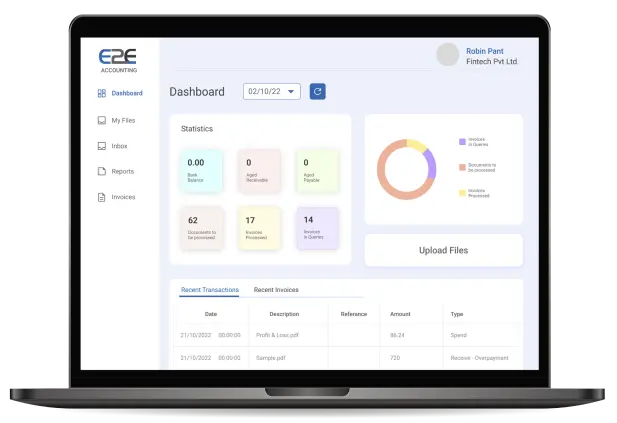

E2E Accounting also offers its own bookkeeping software, Amoeba, which is an easy-to-use platform designed to simplify bookkeeping. If you prefer, we can manage your books on Amoeba, but you are welcome to continue using your current software.

If you are already using software like QuickBooks or Xero, we can seamlessly transfer your closing balances and prepare your books on Amoeba. Our team member from Catch Up Bookkeeping will guide you throughout the transfer process, ensuring everything is accurate and straightforward.

The bookkeeper assigned to you will check all the documents uploaded by you, categorise and record all transactions, reconcile your accounts, and produce financial statements for you. They will also process invoices for you. The bookkeeper will ensure that all your books are tax-compliant and the taxes are filed on time.

We are always happy to support you if you have any queries about your bookkeeping, financial statements, or taxes; you can generally book a call with your bookkeeper, and all your questions will be resolved at the earliest.

Yes, we can help you catch up on your books & filing through our Catch Up bookkeeping package plan. No matter how far behind your books are, we can get you to catch up quickly.

At E2E Accounting, we use Ameoba software. Once you complete the entire registration process with us, you will receive the login credentials of the software. Your assigned bookkeeper will also guide you and provide you with a demo of how to use the software.

You can then effortlessly upload all the necessary documents on the software, and we will take care of the rest.

If you have incurred expenses through a bank account, they are picked from the bank statements. However, if the expenses are incurred in cash, you must provide us with receipts for those transactions. It will also help you in acquiring maximum tax deductions.

Also, at times we can request you the documents, such as account statements or receipts, to cross-check the information and ensure that the posting is correct.

We can help you accurately record all your business transactions from your personal accounts to capture more tax deductions.

Our team will eventually guide you through a complete understanding of the requirements if you want to use your personal account for business purposes.

Once you have selected the plan for the services you wish to enroll in, you can add them to the cart and proceed with making payments. We require signing a 12-month contract.

You can make online payments directly to E2E using any debit or credit card, such as Visa, MasterCard, or American Express.

Payments can also be made through PayPal or by setting up direct debits with us.

If you wish to terminate your contract before the end of the 12-month period, you are required to notify our team at least 3 months in advance.